|

Crisis Research Links

Crisis Experts Survey (56, list below)

The Crisis Books List (>400)

Crisis Journal Articles & Papers

Films & Documentaries

Crisis Cause Summaries

Prescriptions Summaries

Crisis Analogies & Metaphors

Crisis Links

Who warned pre-crisis?

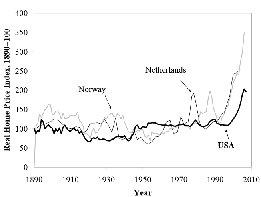

Graphic Source: Robert Shiller (2007)

Crisis Survey Participants

- Viral Acharya (Book)

- Larry Allen (Book)

- Phillip Anderson (Book)

- Dean Baker (Book)

- Clive Boddy (Paper)

- Roddy Boyd (Book)

- Aaron Brown (Book)

- Ludwig Chincarini (Book)

- Aaron Clarey (Book)

- Jesse Colombo (Predicted)

- Jerry Davis (Book)

- Vox Day (Book)

- Kevin Dowd (Book)

- Larry Doyle (Book)

- Fred Foldvary (Predicted)

- James Galbraith (Book)

- Isaac Gradman (Book)

- Jeremy Hammond (Book)

- Robert Hardaway (Book)

- Fred Harrison (Book)

- Michael Hirsh (Book)

- Steve Keen (Book)

- James Kwak (Book)

- Nye Lavalle (Predicted)

- Les Leopold (Book)

- Ross Levine (Book)

- Michael Lim Mah-Hui (Book)

- Robert Litan (Book)

- Francis Longstaff (Paper)

- Johan Lybeck (Book)

- Matthew Lynn (Book)

- Jacob Madsen (Predicted)

- Nolan McCarty (Book)

- Yalman Onaran (Book)

- Ann Pettifor (Book)

- Edward Pinto (Paper)

- Nomi Prins (Book)

- Donald Rapp (Book)

- Assaf Razin (Book)

- Christine Richard (Book)

- Jay W. Richards (Book)

- Robert Rodriguez, (Predicted)

- Richard Roll (Paper)

- John Rubino (Book)

- Nicholas Ryder (Book)

- Hersh Shefrin (Paper)

- Laurence Siegel (Paper)

- Paul Sperry (Book)

- John Talbott (Book)

- Peter Tanous (Book)

- Jennifer Taub (Book)

- Christopher Thornberg (Predicted)

- John Train (Paper)

- Richard Vague (Book)

- John Wasik (Book)

- Matthew Watson (Book)

|

"Wall Street got drunk"

George W. Bush

"Generals prepare for the last war. Economists prepare for the last crisis."

Stanley Fischer

"Like World War II, no single account of this vast and complicated calamity is sufficient to describe it."

Andrew Lo

"THERE WERE all sorts of other problems in the system, and they gave rise to a variety of theories purporting to explain the crisis. The problems were so many and so varied that the crisis became a kind of Rorschach test; you could find at least some evidence to support almost any theory that confirmed your prior ideological biases, no matter where you stood on the political or economic spectrum."

Timothy Geithner in Stress Test

"Accounts of the financial crisis, in particular, have assumed the character of Mr. Potato Head kits. There is a box of standard explanations, and each writer picks the ones he finds most appealing."

Binyamin Appelbaum

"Five years since the collapse of Lehman Brothers, we still lack a true understanding of what caused the financial crisis and Great Recession. Oh, there are standard stories from left and right. Liberals blame a naive faith in free markets, deregulation and Wall Street greed. Conservatives slam government: lax monetary policy and ruinous home-lending by Fannie and Freddie. These selective narratives are self-serving, intended to advance political agendas and not to illuminate the messier reality."

Robert Samuelson

"Lehman was more the consequence than the cause of a deteriorating economic climate. Lehmanís financial plight, and the consequences to Lehmanís creditors and shareholders, was exacerbated by Lehman executives, whose conduct ranged from serious but non-culpable errors of business judgment to actionable balance sheet manipulation; by the investment bank business model, which rewarded excessive risk taking and leverage; and by Government agencies, who by their own admission might better have anticipated or mitigated the outcome."

Anton Valukas (in Lehman's bankruptcy report)

"Instead of a discussion about what happened, we've gotten into a government-vs.-free-market shoutfest. These fragmented days, many people tend to see things in black and white terms, in ways that reinforce what they want to believe. The real world is more complicated than that. Black and white have their places -- but to understand the financial meltdown, you need to see some gray."

Allan Sloan

"You can argue about whether the government could have done better. It certainly could have. You can argue about the government officialsí thinking about how to tackle the crisis, how they approached the bailout. And you could debate their methods. But the problem with the financial crisis, ultimately, isnít that we are still in search of answers. The problem is that so many people donít like the answers."

Andrew Ross Sorkin

ďYou are entitled to your opinion. But you are not entitled to your own facts.Ē

Daniel Patrick Moynihan

Determining the "primary causes" of the Global Financial Crisis is one of the most debated financial tasks in recent decades. There is a long list of suspects, yet more than five years removed from the critical events of the crisis, there is much disagreement over what parties are most responsible for the crisis and what fixes are needed. The Financial Crisis Inquiry Commission (FCIC) was created to determine the primary causes and it's Final Report was released on January 27, 2011. The report included a tremendous amount of information and background, but rather than a single conclusion, the report included a majority view representing the six Commissioners appointed by Democrats and two dissenting views from the Commissioners appointed by Republicans (more background on the FCIC). Determining the "primary causes" of the Global Financial Crisis is one of the most debated financial tasks in recent decades. There is a long list of suspects, yet more than five years removed from the critical events of the crisis, there is much disagreement over what parties are most responsible for the crisis and what fixes are needed. The Financial Crisis Inquiry Commission (FCIC) was created to determine the primary causes and it's Final Report was released on January 27, 2011. The report included a tremendous amount of information and background, but rather than a single conclusion, the report included a majority view representing the six Commissioners appointed by Democrats and two dissenting views from the Commissioners appointed by Republicans (more background on the FCIC).

While researching the crisis I started making a list of books with substantive discussions about the housing crash and/or financial crisis (honestly not realizing what I was getting into and how many have been written). In some cases I asked the authors if they felt their book belongs on the list. Of the more 350 books I've listed, roughly 40 (in bold on the list) qualify as "bestsellers" (The Big Short topped the NYTimes list for an extended period in 2010 and has sold well over 1 million copies worldwide). While researching the crisis I started making a list of books with substantive discussions about the housing crash and/or financial crisis (honestly not realizing what I was getting into and how many have been written). In some cases I asked the authors if they felt their book belongs on the list. Of the more 350 books I've listed, roughly 40 (in bold on the list) qualify as "bestsellers" (The Big Short topped the NYTimes list for an extended period in 2010 and has sold well over 1 million copies worldwide).

The books come from a diverse collection of sources (some lost everything and others that made fortunes). In addition to many books from reporters and journalists, there are books by professionals in the mortgage, real estate, and investment industries, government officials, and academics around the world. Given the divide that emerged among the FCIC commissioners, some fear that we may never get a consensus conclusion about the primary crisis causes. I am attempting to clarify opinions by surveying the authors about the FCIC report, the primary causes of the crisis, and their prescriptions. The books come from a diverse collection of sources (some lost everything and others that made fortunes). In addition to many books from reporters and journalists, there are books by professionals in the mortgage, real estate, and investment industries, government officials, and academics around the world. Given the divide that emerged among the FCIC commissioners, some fear that we may never get a consensus conclusion about the primary crisis causes. I am attempting to clarify opinions by surveying the authors about the FCIC report, the primary causes of the crisis, and their prescriptions.

The Book list is split by 1) pre-crisis books (some arguably predicted or at least warned pre-crisis) and 2) the books that have been written since the crisis began. Clearly, some that claimed to have predicted the crash were at a minimum "early" and some predicted a real estate crash but limited impact on the overall economy. Separately, predicting the crisis didn't necessarily translate into profits or reduced losses. Still, Robert Shiller predicted the real estate bubble bursting as well as warned about the dot.com bubble, and I personally clipped this 7/5/2006 WSJ article in which Ken Heebner predicted a major price drop in hot real estate markets. Of course, there have also been numerous books documenting our history of financial debacles (like Extraordinary Popular Delusions and The Madness of Crowds which was first published in 1841, and Manias, Panics, and Crashes: A History of Financial Crises which was first published in 1978). The Book list is split by 1) pre-crisis books (some arguably predicted or at least warned pre-crisis) and 2) the books that have been written since the crisis began. Clearly, some that claimed to have predicted the crash were at a minimum "early" and some predicted a real estate crash but limited impact on the overall economy. Separately, predicting the crisis didn't necessarily translate into profits or reduced losses. Still, Robert Shiller predicted the real estate bubble bursting as well as warned about the dot.com bubble, and I personally clipped this 7/5/2006 WSJ article in which Ken Heebner predicted a major price drop in hot real estate markets. Of course, there have also been numerous books documenting our history of financial debacles (like Extraordinary Popular Delusions and The Madness of Crowds which was first published in 1841, and Manias, Panics, and Crashes: A History of Financial Crises which was first published in 1978).

The beginning date and event of the crisis are debatable. HSBC's 2/7/2007 announcement that it anticipated increased losses from subprime mortgages is considered by some to be the start of the crisis, and it was followed by New Century's 4/2/2007 bankruptcy. Yet the stock market didn't peak until 10/9/2007 and JP Morgan's purchase of Bear Stearns wasn't until 3/16/2008. The crisis intensified in September of 2008 with the government seizures of Fannie Mae and Freddie Mac, Lehman Brothers bankruptcy, BofA's purchase of Merrill Lynch, the government loaning AIG $85 billion, and Washington Mutual's bankruptcy and asset sale to JP Morgan. Yet the stock market did not bottom until 3/9/2009. The beginning date and event of the crisis are debatable. HSBC's 2/7/2007 announcement that it anticipated increased losses from subprime mortgages is considered by some to be the start of the crisis, and it was followed by New Century's 4/2/2007 bankruptcy. Yet the stock market didn't peak until 10/9/2007 and JP Morgan's purchase of Bear Stearns wasn't until 3/16/2008. The crisis intensified in September of 2008 with the government seizures of Fannie Mae and Freddie Mac, Lehman Brothers bankruptcy, BofA's purchase of Merrill Lynch, the government loaning AIG $85 billion, and Washington Mutual's bankruptcy and asset sale to JP Morgan. Yet the stock market did not bottom until 3/9/2009.

I use the term "Global Financial Crisis" but other (arguably related) terms have been suggested including "The Second Great Contraction," "The Great Recession," "The Global Recession," "The Global Debt Crisis," The Credit Crunch," "The Great Slump," or "The Financial Debacle." I created this page to serve as a central portal for research on the topic, which I began aggregating on my web site investorhome.com in 2011. I use the term "Global Financial Crisis" but other (arguably related) terms have been suggested including "The Second Great Contraction," "The Great Recession," "The Global Recession," "The Global Debt Crisis," The Credit Crunch," "The Great Slump," or "The Financial Debacle." I created this page to serve as a central portal for research on the topic, which I began aggregating on my web site investorhome.com in 2011.

© COPYRIGHT 2014-2019 ALL RIGHTS RESERVED GFCRESEARCH.COM (5/21/2019) DISCLAIMER |

Must Reads and Links

Insider Takes

Blogs

GFC Legal Tab

(WSJ),

Bailout Tracker (Propublica)

Baseline,

Cowen,

HouseofDebt,

Krugman,

Mankiw,

Taylor

My reading list & comments (by publication date)

- The Trillion Dollar Meltdown (3/4/2008)

- The Cost of Capitalism (4/14/2008)

- Bad Money (4/15/2008)

- Chain of Blaim (7/8/2008)

- Animal Spirits (1/29/2009)

- The 86 Biggest Lies on Wall Street (4/27/2009)

- Street Fighters (5/12/2009)

- Fool's Gold (5/12/2009)

- The Myth of the Rational Market (6/9/2009)

- In Fed We Trust (8/4/2009)

- This Time Is Different (9/11/2009)

- Too Big To Fail (10/20/2009)

- The Greatest Trade Ever (11/3/2009)

- On the Brink (2/1/2010)

- Return to Prosperity (2/9/2010)

- The Big Short (3/15/2010)

- The Devil's Casino (3/22/2010)

- The End of Wall Street (4/6/2010)

- Crisis Economics (5/11/2010)

- More Money Than God (6/10/2010)

- The Weekend That Changed Wall Street (9/7/2010)

- Griftopia (11/2/2010)

- All the Devils Are Here (11/16/2010)

- Beyond the Crash (12/7/2010)

- Financial Crisis Inquiry Commission Final Report (1/27/2011)

- Wall Street & the Financial Crisis - Anatomy of a Financial Collapse (4/13/2011)

- Reckless Endangerment (5/24/2011)

- Confidence Men (9/20/2011)

- Debunking Economics (my review) (10/25/2011)

- The Occupy Handbook (my review) (4/17/2012)

- Bull by the Horns (9/25/2012)

- After the Music Stopped (1/24/2013)

- The Global Economic Crisis: A Chronology (4/1/2013)

- The Map and the Territory (10/22/2013)

- Stocks for the Long Run (5th edition) (12/23/2013)

- Stress Test (my review) (5/12/2014)

- The Financial Crisis and White Collar Crime (7/31/2014)

- The Courage to Act (10/5/2015)

- Too Smart for Our Own Good (12/5/2018)

Post-panic, as part of my research on who warned in advance of the crisis, I also read

How to Profit from the Coming Real Estate Bust (2003),

The Coming Crash in the Housing Market (2003), Sell Now!: The End of the Housing Bubble (2006), and Financial Armageddon (2007). I had previously read Extraordinary Popular Delusions and The Madness of Crowds, and the fifth edition (2005) of Manias, Panics, and Crashes: A History of Financial Crises.

Notable Citations

|

|